Economic interdependence, once seen as a stabilising force for the world, is being increasingly weaponised, as seen in trade wars, sanctions, and the deliberate decoupling of supply chains in critical industries.

Geopolitical risks today exceed levels seen during the Cold War, driven by heightened military spending, stalled efforts at nuclear disarmament, and a diminished role for multilateral institutions like the United Nations. The Geopolitical Influence & Peace report identifies that further complicating the picture is economic stagnation, as developing nations grapple with mounting debt burdens that divert critical resources away from health, education, and infrastructure.

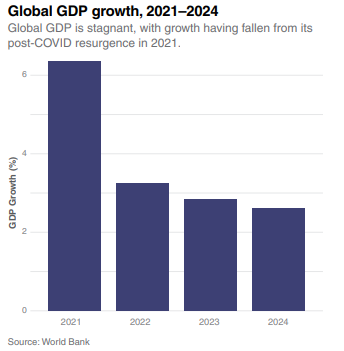

Global economic growth has slowed since the temporary resurgence following the pandemic induced recessions of 2020. Contemporary global economic stagnation, marked by slow or stagnant growth across major economies, is a key factor shaping geopolitics in the 21st century.

Rising inflation, uneven recovery from the COVID-19 pandemic, and the economic fallout from geopolitical tensions, such as the Russia-Ukraine war, have strained international trade, disrupted supply chains, and exacerbated debt vulnerabilities in developing nations. These economic pressures have fuelled domestic instability in many countries, heightened competition for resources, and amplified protectionist policies.

For geopolitics, this stagnation influences power dynamics, as nations with resilient economies leverage their stability to expand influence, while weaker economies face greater susceptibility to external pressures and internal discontent. As global cooperation becomes increasingly fragmented, addressing economic stagnation has emerged as a critical task for sustaining international peace and stability.

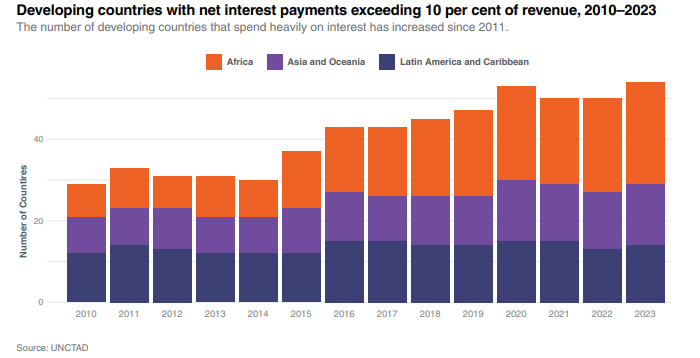

Rising debt levels are another economic dynamic of growing importance, compounded by low global economic growth. In 2023, global public debt reached a record high of $97 trillion. The growth of debt has been particularly pronounced in developing countries, which outpaced debt growth of developed nations by a factor of two since 2010. A record number of developing economies now spending over 10 per cent of their annual revenue on interest payments for existing loans.

Developing countries spending over 10 per cent of their annual revenue on servicing interest on debt face significant challenges that directly impact global peace and security. This financial burden limits their ability to invest in critical sectors such as healthcare, education, and infrastructure, exacerbating poverty and inequality. The strain also undermines state capacity to address grievances, fuelling public dissatisfaction and creating fertile ground for social unrest, political instability, and violent conflict.

Furthermore, these fiscal constraints often force reliance on external creditors, increasing geopolitical dependencies that can heighten tensions and erode national sovereignty. The inability of these countries to achieve sustainable development amidst such financial pressure not only destabilises their regions but also has spillover effects, including migration crises and the spread of transnational threats, making this issue a priority for maintaining global stability.

The world is more connected economically through trade than it was during the Cold War, with deep economic interdependence between the US and China, contrasting sharply with the dynamics of the isolated blocs of the Cold War. Economic ties and interdependence, long seen as stabilising forces for international relations, grew sharply after 1990. However, the level of trade as a percentage of world GDP has plateaued over the past decade, suggesting further growth may be unlikely, particularly if countries increasingly rely on tariffs.

The threats of trade tariffs by US President Donald Trump could reverse the trend which has seen a decline in tariffs worldwide. President Trump, who in his previous leadership term from 2016-2020 engaged in a trade war with China, has now said Mexico and Canada could face 25% across-the-board tariffs on goods from their nations being exported to the US.

Mexico’s President Claudia Sheinbaum responded with a warning of dire economic consequences for both countries from tariffs and suggested possible retaliation leading to a cycle which will hurt both nations.

“One tariff will follow another in response and so on, until we put our common businesses at risk,” Sheinbaum said in a letter to Trump, warning that tariffs would cause inflation and job losses in both countries.

Some financial analysts agreed, but also believed Trump’s announcement was a negotiating tactic, given that imposing the tariffs would also be negative for the US economy.

Mexico is the country’s top trade partner as of September, representing 15.8% of total trade, followed by Canada at 13.9%. Trump also threatened “an additional 10% tariff, above any additional tariffs” on imports from China, the third-largest trade partner at 11.9%.

Trade is also being impacted by growing geopolitical tensions. Disruptions caused by Russia’s invasion of Ukraine in 2022 led to rising food, fuel, and fertiliser prices that particularly hurt developing countries. In addition, competition between the US and China led both countries to impose retaliatory tariffs against each other beginning in 2018, according to IEP’s Multilateralism Index 2024.

Despite some fluctuations, particularly a COVID-triggered spike in 2019, tariffs on agriculture, manufacturing, and natural resources have all slightly decreased over the past decade. Still, tariffs remain high in certain sectors, particularly on agricultural and textile products exported by developing countries.

Another alternative restriction on trade are non-tariff barriers, such as technical regulations for imported goods or anti-dumping rules. These barriers, which now affect 70% of world trade, have come to have an even bigger impact than formal tariffs.

The concern for 2025 is that a resumption in the use of trade tariffs could trigger a trade war, which in combination with non-tariff barriers, could result, as Mexican President Sheinbaum warned, in widespread negative impacts.