ESGs are increasingly becoming not just an afterthought, but an embedded part of business strategy; acting as a key motivator for regulator, consumer and investor behaviours. These Environmental, Social and Governance factors:

(E) lead to environmental sustainability

(S) promote social justice, well-being and development, and

(G) encourage accountable and transparent organisational governance.

ESG reporting frameworks enable businesses and their stakeholders to ensure that business strategy aligns with their principles while having a meaningful, measurable and positive impact on society. Furthermore, these standards are valuable tools in ensuring businesses are aligning with broader frameworks that promote action, such as the UN Sustainable Development Goals. However, despite the increased recognition of ESGs and acknowledgment of their value, all too often there remains a stark disconnect between identification and implementation.

The economic shocks of the COVID-19 pandemic, compounded by the impact of the war in Ukraine, mean the world is facing a particularly challenging economic outlook. In such challenging economic circumstances, businesses that are struggling could be tempted to cut corners and avoid devoting resources to furthering their ESG compliance. However, while this may seem beneficial in the short-term, research from accountancy firm Moore Global, suggests that businesses who have shown an ‘express commitment to ESG’ compliance saw a 9.1% increase in profits over the last three years.

Furthermore, IEP’s research suggests that businesses that invest in ESG compliance tend to be more transparent and more responsibly managed than their peers. Focusing investments on these businesses can protect investors and potentially ensure they avoid future losses associated with regulation, litigation, compensation and remediation, all of which are more likely to occur in less ethically-managed businesses.

On the macro level, governments that embrace ethical principles are also likely to achieve greater economic success. These strategies are likely to produce more effective policies, minimise losses from corruption or inefficiency, and produce and support more effective and robust institutions. These outcomes have been evidenced by the results of the ESG version of the widely used financial benchmark MSCI World, which outperformed its non-ESG equivalent between 2007 and 2018.

IEP’s Positive Peace framework has utility as a predictive tool for economic performance. IEP’s research empirically shows that the countries that fare the best in the Global Peace Index (GPI) are also those with the most favourable business environments.

Lithuania is just one example of this trend. Between 2009 to 2019 Lithuania’s Positive Peace Index (PPI) score improved by 13.9%, the highest improvement of any country in Europe during this period. This improvement was accompanied by a boom in manufacturing that followed a huge spike in foreign direct investment. All domains and Pillars of Positive Peace improved in Lithuania over this period and the government enabled this. They streamlined the process of obtaining construction permits, updated the country’s urban zoning planning frameworks from the Soviet era, and eased the tax burden on hiring labour which created thousands more jobs. A 2018 report carried out by Cushman & Wakefield – The Global Manufacturing Risk Index – placed Lithuania as the world’s second-most attractive destination for manufacturing.

Changes to Positive Peace are auto-regressive and self-reinforcing. Once a PPI score improves for a country or region in a given year, it will tend to continue improving for some time in the future; and the better a PPI outcome in a given year, the higher the probability of a favourable economic result in the future.

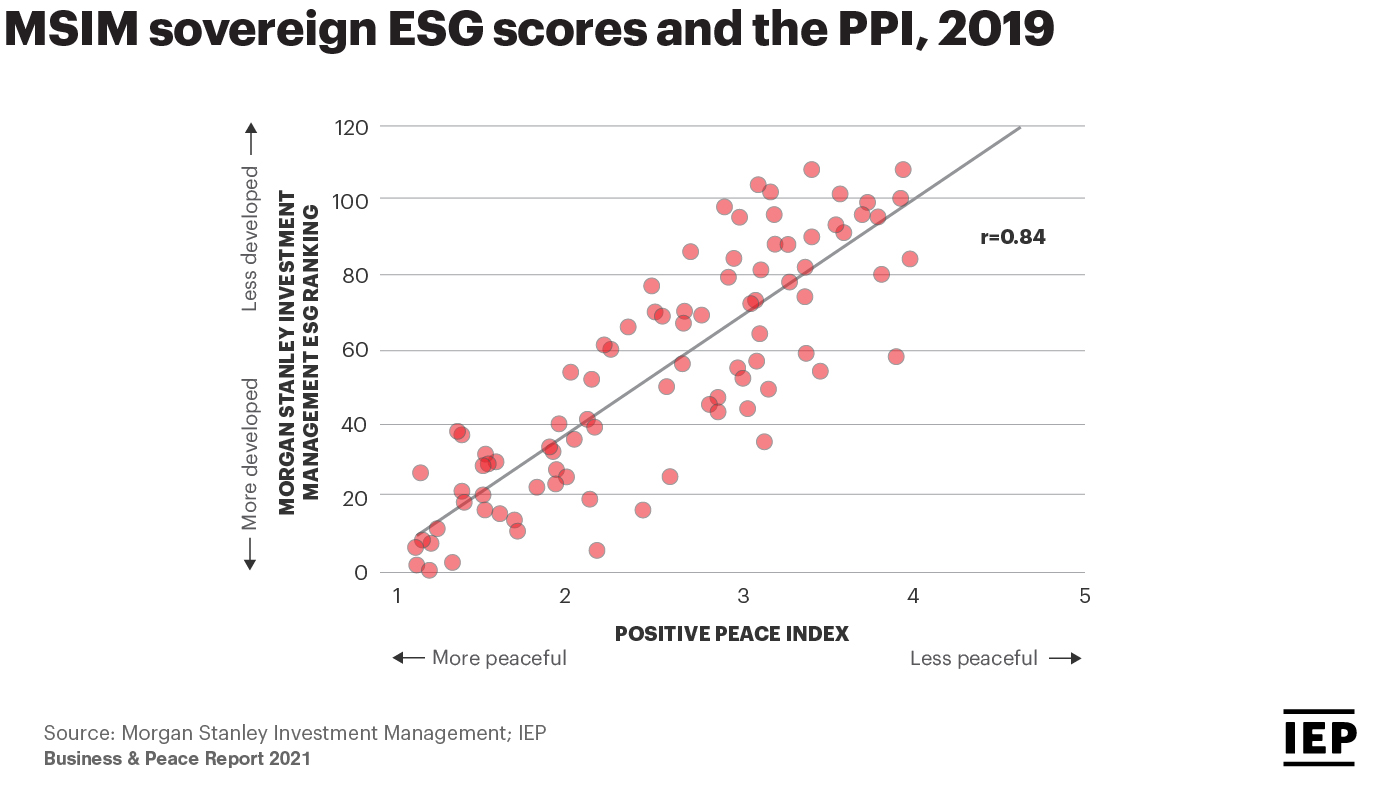

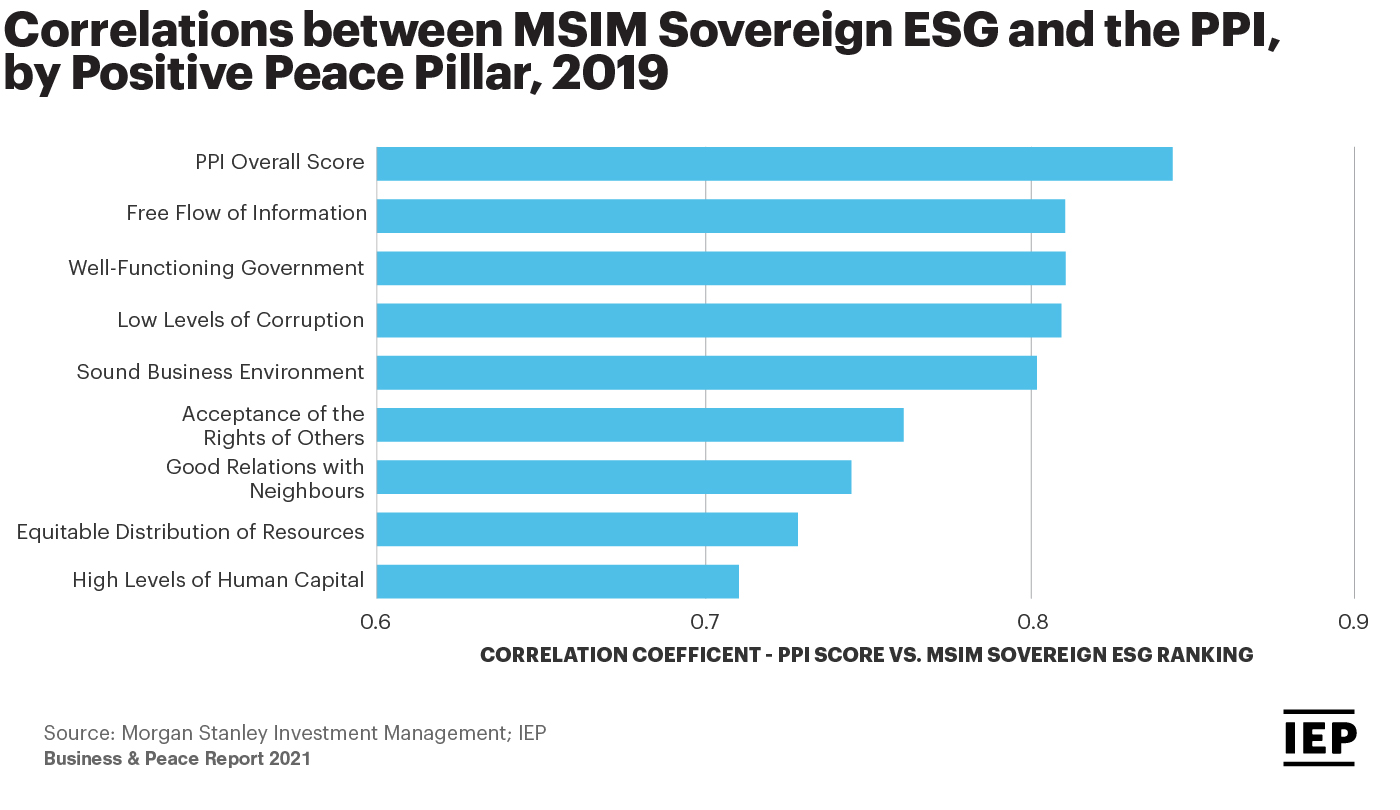

The Positive Peace framework has significant conceptual and empirical overlap with the concept of ESG and the PPI, with the correlation between the PPI and Morgan Stanley Investment Management’s (MSIM) sovereign ESG ranking being 0.84. This dynamic means that changes to Positive Peace are an accurate method of predicting future developments in ESG scores. This ensures that ethical investors and stakeholders in ESG sectors are able to assess which nation states will improve in ESG ratings and which will deteriorate, enabling them to appropriately direct their investments.

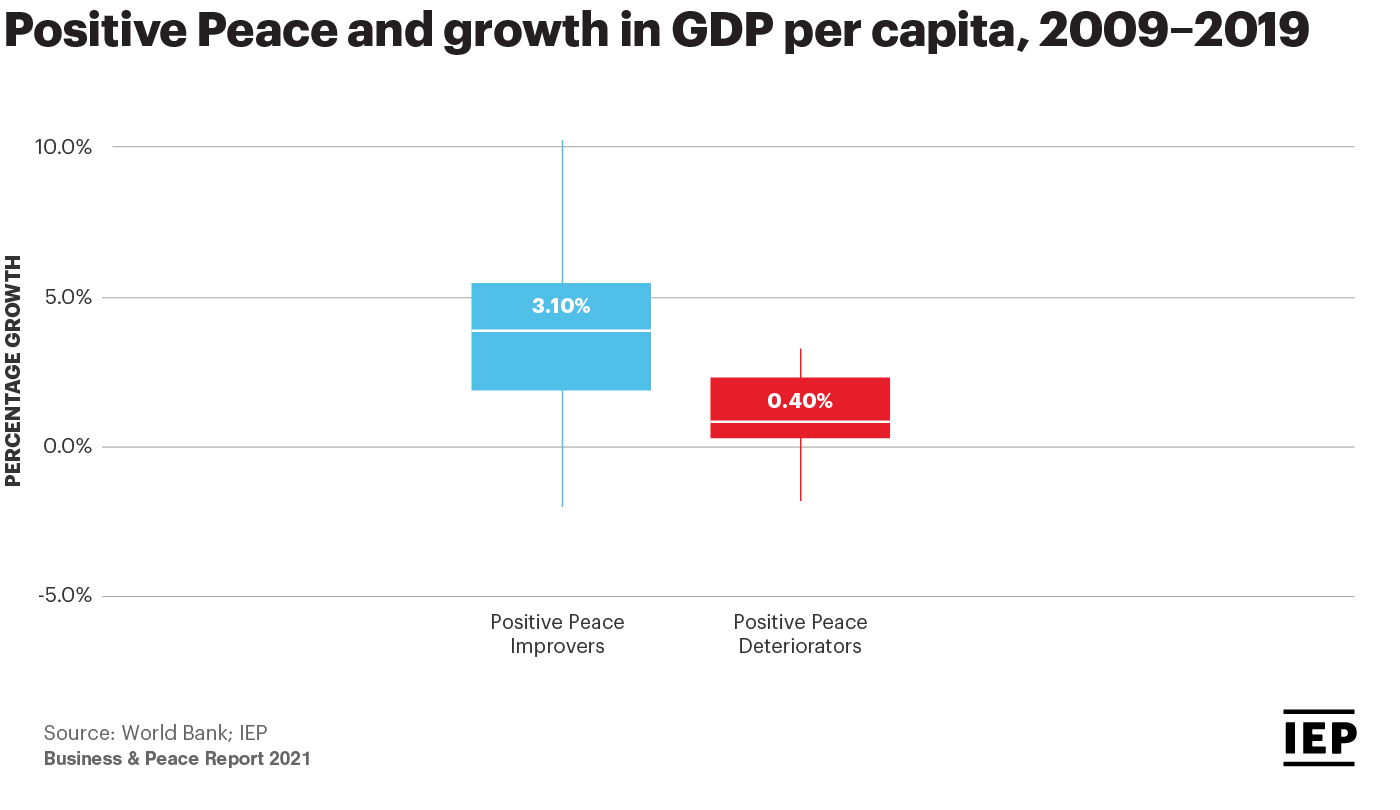

IEP’s research identifies a pattern, wherein if a country performs better with regards to Positive Peace and ESG, profitability also improves. This is apparent with regards to foreign direct investment, which, in the decade to 2019, rose at an annual rate of 5.2% for countries that improved on the PPI, double the rate of that in countries in which Positive Peace deteriorated. Furthermore, inflation in the countries that improved their PPI ranking was three times less volatile than countries where PPI deteriorated, offering a far more stable environment for investment.

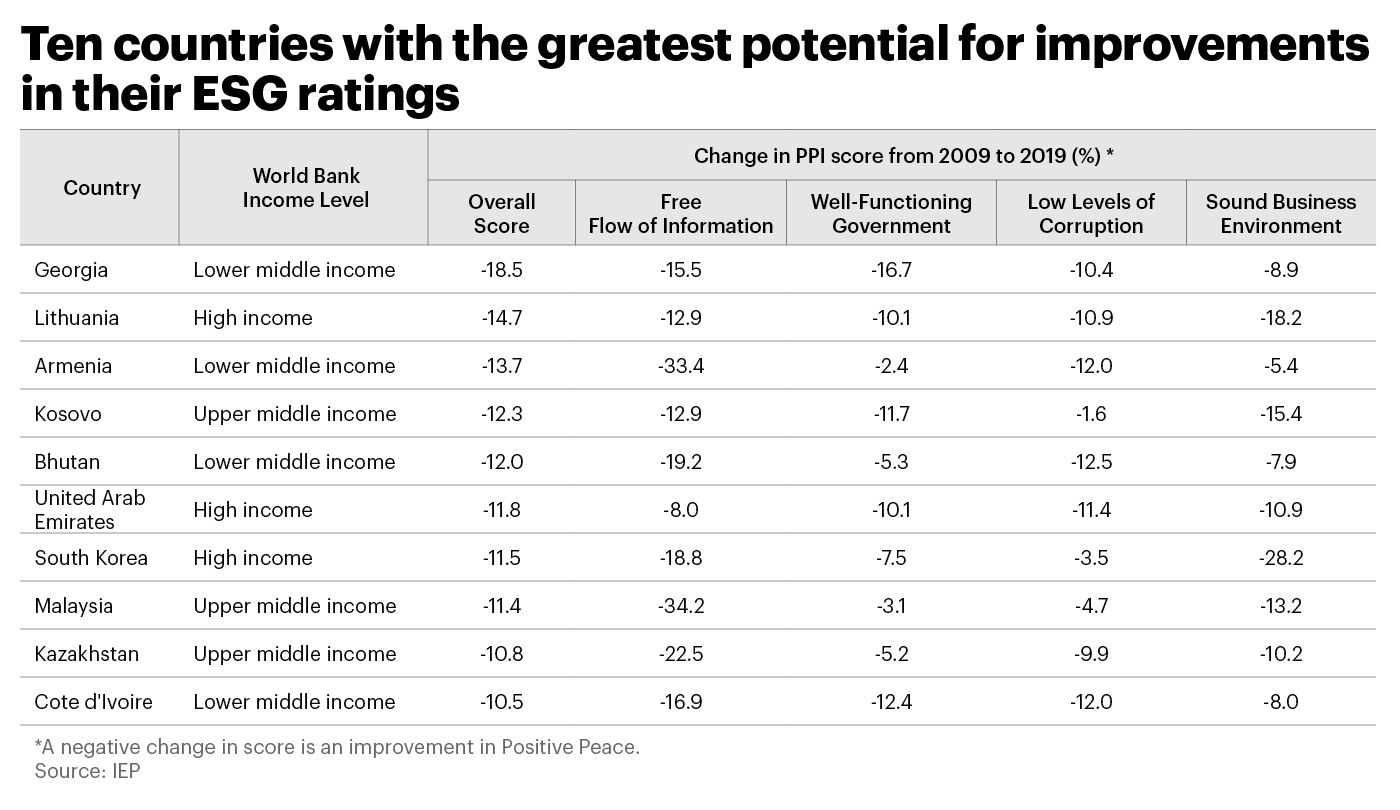

IEP’s research has identified 20 countries who have seen substantial improvements in overall Positive Peace, coupled with improvements in the four specific pillars that are highly-correlated to ESG measures. These are the countries with the highest probability of improvements in their ESG ratings in the future, and could potentially offer good investment opportunities for ethical funds and investors.

While development is not linear, and these countries may well face issues along the way, what this research indicates is that the ESG evaluations of these countries will likely be more favourable in the future than they are today indicating there is significant opportunity for growth.

Efforts to decarbonise the global economy also offer enormous opportunities for investment, and as a result the Environmental pillar of ESG has come under particular focus in recent years, with investments in renewables gathering pace. The war in Ukraine has triggered a rapid acceleration in Europe’s drive to wean itself off Russian oil and gas, producing an enormous leap forward in renewable energy investment in the region.

Framing profitability and sustainability as a trade-off is problematic and shortsighted. Ethical investment, when carried out responsibly, should be viewed as a sustainable and responsible future-proof approach to investment, rather than a potential barrier to profit.

The benefits of intertwining ESG compliance with business strategies are clear to see, with both consumers and employees being highly motivated by these ethical considerations. Research from Oxford Economics and SAP highlights that 80% of business leaders reported witnessing ‘increased innovation and greater brand loyalty’ as a result of increased ESG compliance.

Conversely, paying lip service to ESG compliance, such as overstating environmental commitments or greenwashing, is empirically proven to cause damage to businesses’ reputations and can result in ‘real financial costs’ as consumers look elsewhere and employees feel demotivated.

IEP’s research on Positive Peace is already being used in the private sector to guide financial investment strategies in order to promote peace and boost social progress. As climate-related threats and their associated costs continue to grow, the need for these investments will also increase, presenting ethical investors with greater opportunities. If investors, businesses and consumers can collectively work together to leverage a larger proportion of the world’s private capital towards more sustainable projects, this could have a transformative impact, benefitting both investors and society as a whole.