A growing number of financial market investors are guiding their strategies using ethical investment principles. These principles often seek beneficial environmental, social and governance (ESG) outcomes that promote social progress and sustainable business practices.

At a superficial glance, ESG strategies may seem less profitable than conventional investments. This would reflect the added cost of implementing socially responsible initiatives or complying with more stringent operational standards. In addition, by excluding non-compliant companies or countries, an ESG portfolio would theoretically be less diversified than a standard counterpart.

However, ESG investing can be more advantageous than conventional strategies, especially in the medium to long term.

Companies that adhere to ethical principles tend to be more transparent and responsibly managed than their peers. Further, they may pre-empt and avoid future losses associated with regulation, litigation, compensation and remediation. They are also likely to be better managed than their peers, as the operational principles necessary for a company to receive favourable ESG ratings will also lead to a long-term view on a sustainable business.

Governments that embrace ethical principles are more likely to produce effective policies and minimise losses from corruption and inefficiency. These institutions are usually more resilient and adaptable than their counterparts.

Reflecting all these factors, the ESG version of the widely used financial benchmark MSCI World stock price index outperformed its non-ESG equivalent between 2007 and 2018.

Fund managers can also use ESG principles to assess the resilience and business model sustainability of companies in which they invest. Increasingly, this is happening even when the funds they manage are not necessarily targeted at ethical investors. As a result, ESG is becoming more widespread as a useful risk management tool in the wider financial markets.

Positive Peace provides a theory of change and describes the necessary background conditions that lead to improvements in ESG measures.

In addition, changes in Positive Peace and the associated trends are long lasting, in that they take multiple years to work themselves through. This means they are an accurate way to predict future developments in ESG scores. This opens the possibility for ethical investors and stakeholders in ESG sectors to assess which nation states will improve in ESG ratings and which will deteriorate.

This work can be coupled with analysis of the actual peace of the countries – through the Global Peace Index (GPI), the Global Terrorism Index (GTI) and other national peace indices – to enhance the accuracy of ESG forecasts.

The measures of peace and Positive Peace are intrinsically connected principles. Therefore, analysing these relationships across countries and time can add value to ESG research.

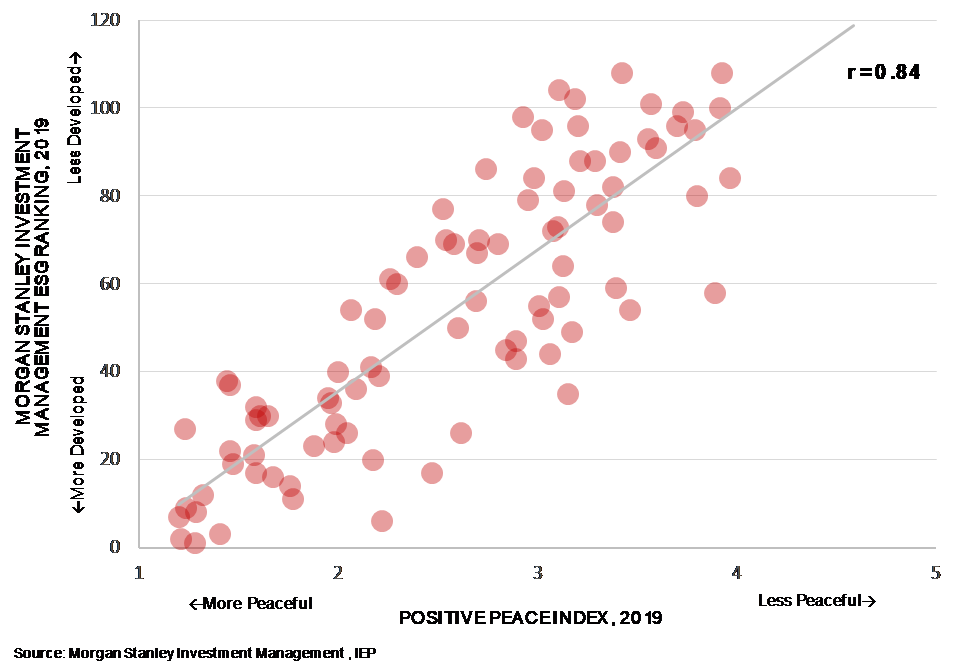

Because of the conceptual and empirical overlap between ESG and Positive Peace, the PPI can be used as a gauge of sovereign ESG performance. The correlation between the PPI and Morgan Stanley Investment Management’s (MSIM) sovereign ESG ranking is 0.84.

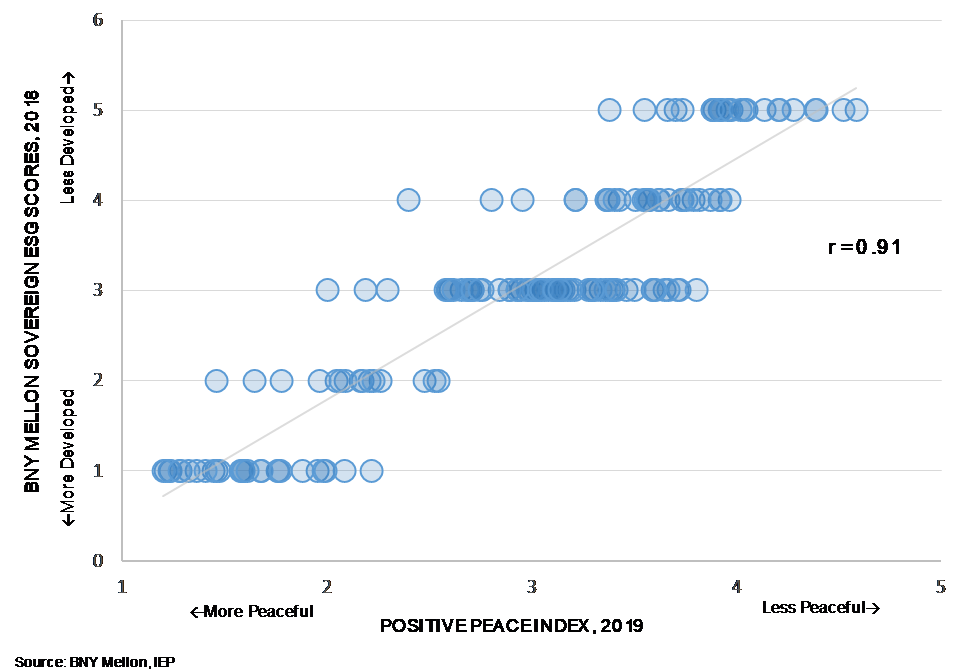

The correlation coefficient between the PPI and sovereign ESG scores computed by BNY Mellon’s Insight Investment for 186 countries in 2018 is 0.91.

These empirical results show that Positive Peace is an accurate predictor of ESG outcomes from the point of view of sovereign nation state classifications.

Sovereign nation state ESG scores are used in two ways:

To help investors with sovereign exposures – such as bonds, equity indices, credit default swaps and other derivatives – assess the alignment of their portfolios with ethical investment principles.

To inform companies with assets and operations in given nation states about these nations’ commitment to ethical and sustainable development. When companies carefully assess this commitment and implement ethical standards in their own management and operations, these companies themselves are acting in accordance with ESG principles. This makes them more valuable for ethical investment fund managers and private investors.